Forecast and evaluate business risk exposures to manage future loss

When evaluating potential losses to identify and reduce business risk exposures, name your biggest nightmare. What’s the worst that could happen in your business or organization? A fire, a lawsuit, death of a key executive, employee theft, reputation failure…. All these and more can cause major losses. Worst case scenario: they can shut you down.

Whether yours is a large company with loss management tasks handled by your COO and accounting team, or you operate a smaller business without those capabilities, rest assured: ACM has your back, with claims staff ready to help.

Just how does risk management or loss management work, you ask? Here’s a brief run-down that can help.

How to identify and reduce business risk exposures

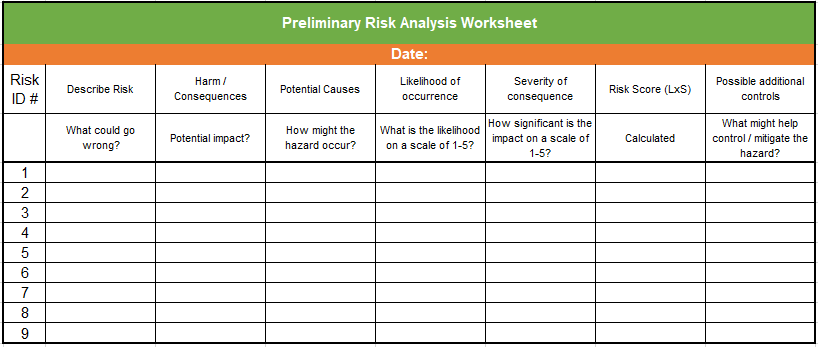

Your goal in assessing your business risk exposures is to decrease either the likelihood, or the impact of, an identified risk (or both, if possible). That’s why it’s important to first write down every potential risk you can think of, and then rate them. Here’s a sample chart that you can use. (Click on the downloadable version at the end of this post.)

Next to the risk, its impact, its cause(s), you’ll then rate the likelihood and the severity of your risk, on a scale of 1-5. When you multiply them together (likelihood x severity), that number is key. You’ll want to start working on those higher scoring risks first, and then work your way down to those that occur rarely-to-never, or would have very little impact.

If possible, we suggest that you don’t create this document by yourself. Have key employees add their input, because chances are, they see risks and challenges you may not see.

Now it’s time to create a plan that involves implementing the action steps you added in the last column. How can you lessen or control the possibility of each risk occurring, or their impact on your business? As you think through each risk, assign a person to handle those tasks; then collaborate with them for their suggestions on how to mitigate the risk.

HOW TO LESSEN THE IMPACT OF YOUR BUSINESS RISK EXPOSURES

In planning out your tasks, we suggest you keep these points in mind:

- Focus on high-exposure risks (highest risk scores on your chart)

- To maximize impact, address the consequences

- To reduce the likelihood, address the cause (not just the symptoms)

- Once you’ve determined the root cause, look for similar situations in other areas that may arise from the same cause (similar to a domino effect)

- Take into account any dependencies and interactions that may occur among risks

They also suggest these approaches to identifying and managing your business risk exposures:

Mitigate. This is the topic of this blogpost, which involves planning ahead of a loss, so that you can reduce the probability and or the severity of a risk. However, it’s not always possible, in which case you want to consider one of these alternatives.

Accept. In many businesses, owners simply need to accept the fact that there will be losses. For instance, if you have a construction firm, you know that eventually a worker will be injured. This doesn’t mean you do nothing; instead, you do all you can to lessen the likelihood and severity of the risk, but you also have workers’ benefits coverage as a fall-back.

Plan for contingencies. In the injured worker example, your management of business risk exposures doesn’t stop with insurance. You also need a contingency plan for bringing that worker back on the job (i.e., a return-to-work program). If your computers are frozen by ransomware, what is your contingency plan until they’re back in operation? If a delivery vehicle is in the shop for repairs, what are your alternatives? That’s contingency planning.

Finally, keep track of your risks that become a reality, and analyze your treatment of the process. What did you learn, and what will you do differently next time? What additional tools, training, staff or policies need to be added or modified? Download our spreadsheet to help you begin planning.

This article originally appeared in Arrowhead Tribal’s blog. It has been updated and modified to better fit the needs of ACM’s self-insured clients and insurance companies.